Support for the TCFD Recommendations

With the issue of climate change growing increasingly serious, the Financial Stability Board established the Task Force on Climate-related Financial Disclosures (TCFD), which in 2017 announced its recommendations. These recommendations encourage companies to disclose information related to climate change so that investors can appropriately assess climate-related risks and opportunities.

Recognizing the potential of climate change to present medium- to long-term risks and opportunities that affect its business domains, in July 2021 MITSUBISHI MOTORS expressed its support for the TCFD Recommendations. Accordingly, we are analyzing the impact of climate change on our businesses and finances (scenario analysis). We will reflect the results of scenario analysis in our management strategies to enhance the resilience of our strategies and improve information disclosure in accordance with the TCFD Recommendations.

Governance

Management Structure

a.Board’s oversight of climate-related risks and opportunities

The Group recognizes “responding to climate change and energy issues” as an important management issue and has accordingly identified it as one of our materiality issues. The Board of Directors makes decisions on important matters related to environmental initiatives, including those related to climate change, and oversees their execution. The Board of Directors approved the “Environmental Vision 2050” and “Environmental Targets 2030,” which were revised in FY2022, and these measures were announced.

Examples of climate change-related issues discussed or reported by the Board of Directors

- Endorsement of TCFD recommendations

- Disclosure in line with TCFD recommendations

- Declaration of intent to achieve carbon neutrality by 2050 and revision of Environmental Vision 2050

- Revision of Environmental Targets 2030

b.Management’s role in assessing and managing climaterelated risks and opportunities

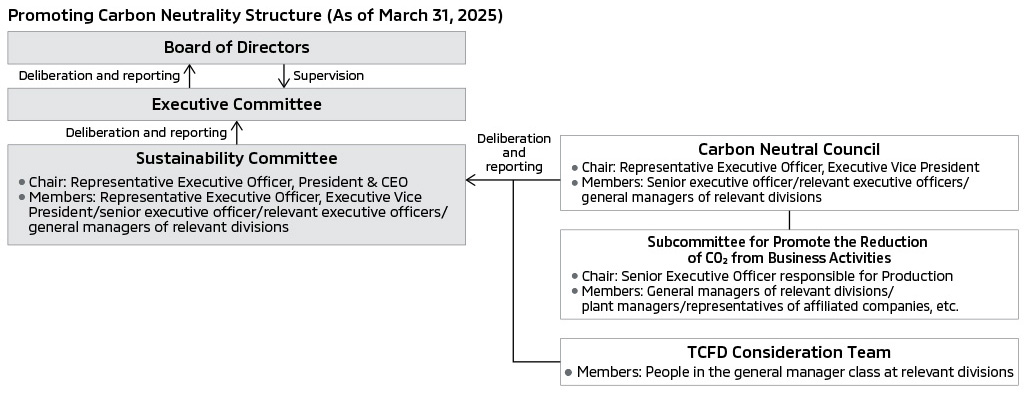

To address climate change and energy issues, we have established the Sustainability Committee, chaired by the Representative Executive Officer, president & CEO, who also holds top responsibility for initiatives related to climate change. The committee evaluates climate-related risks and opportunities, discusses response measures, and reviews progress and achievements in line with the Environmental Targets 2030.

We have established the Carbon Neutrality Council under the Sustainability Committee. This council is chaired by the Representative Executive Officer, Executive Vice President and consists of executives responsible for management strategy, products, manufacturing, procurement and logistics. This organization formulates medium- to long-term policies and goals based on the assessment of climate-related risks and opportunities, considering specific response measures in each area. These policies, goals, and their progresses are reported by the respective heads of each area at the Sustainability Committee for review and deliberation. The organization generally meets three times per year, and particularly important matters are deliberated and decided by the Board of Directors.

| Roles | Meeting frequency | |

|---|---|---|

| Sustainability Committee | Monitoring Progress toward the Environmental Targets 2030 | Three times a year |

| Carbon Neutral Council | Formulating medium- to long-term policies and targets for achieving carbon neutrality by 2050 | Three times a year |

| Subcommittee for Promote the Reduction of CO2 from Business Activities | Draft action plans for reducing CO2 in areas of business activity, promotion of specific measures, etc. | Twice a year |

| TCFD Consideration Team | Identify and assess climate-related risks and opportunities, consider scenario analysis, etc. | Meets as necessary |

Strategy

Risks and Opportunities

a.Short-, medium- and long-term climate-related risks and opportunities the organization has identified

The Group considers climate-related risks and opportunities to be an important perspective in the formulation of our business strategy. We are identifying and evaluating short-, medium-, and long-term risks and opportunities, as well as analyzing the impact on our business based on multiple climate scenarios. We are also considering countermeasures in response to these risks and opportunities.

As particularly high-impact migration risks, we identified the “strengthening of regulations for fuel economy/CO2 and zero-emission vehicles” and the “introduction and expansion of carbon pricing.” We identified “increasing frequency and intensity of meteorological disasters” as a physical risk. While these risks may affect our business in various ways, we recognize that responding appropriately to these risks will lead to greater sales of electrified vehicles*1 and new business opportunities.

- Electrified vehicles: Battery-powered electric vehicles, plug-in hybrid electric vehicles (PHEV), and hybrid electric vehicles (HEV)

Identified climate-related risks and opportunities

| Type | Item | Assumed Impact on MITSUBISHI MOTOR’S Business Activities | Timing of the Impact*2 |

Degree of impact | |

|---|---|---|---|---|---|

| Transition risks | Policy and legal | Strengthening of regulations for fuel economy/CO2 and zero-emission vehicles |

|

Short/medium/long term | Large |

| Introduction and expansion of carbon pricing |

|

Medium/long term | Large | ||

| Technology | Investment in new technologies |

|

Short/medium/long term | Medium | |

| Market | Changes in the energy mix |

|

Medium/long term | Small | |

| Tight supply and demand for raw materials (rare metals) |

|

Medium/long term | Medium | ||

| Changes in user awareness and behavior |

|

Medium/long term | Medium | ||

| Reputation | Increasingly stringent assessment by ESG rating institutions and stakeholders |

|

Short/medium term | Medium | |

| Physical risks | Acute | Increasing frequency and intensity of meteorological disasters |

|

Short/medium/long term | Large |

| Chronic | Rise in average temperatures |

|

medium/long term | Small | |

| Rise in ocean levels |

|

Medium/long term | Medium | ||

| Opportunities | Products and services | Growing demand for electrified vehicles |

|

Medium/long term | Large |

| Energy source | Advancement in energy technologies |

|

Short/medium/long term | Medium | |

- Short term: Up to three years; medium term: three to 10 years; long-term: more than 10 years. Some issues impacts have already occurred as a result of the recent international situation.

- A general term encompassing vehicle to home (V2H) and vehicle to grid (V2G), among others

b.Impact of climate-related risks and opportunities on the organization’s business, strategy, and financial planning

With the vision of “creating vibrant society by realizing the potential of mobility,” the Group aims to enhance our corporate value over the long term by providing products with value that is unique to MITSUBISHI MOTORS through contributions to carbon neutrality and other efforts. As society-wide efforts to achieve carbon neutrality accelerate, we recognize that climate-related matters may affect our business, strategies, and financial plans, so we periodically review our strategies and plans as appropriate based on climate change risks and opportunities.

c.Resilience of the organization’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario

Intergovernmental Panel on Climate Change (IPCC), and the Network for Greening the Financial System (NGFS), MITSUBISHI MOTORS considered the “less than 2°C scenario*4,” which assumes actions by society to avoid climate change as of 2030 and 2050. We also looked at a “growth scenario*5,” which assumes national policies continue to grow more stringent. Under these scenarios, we examined the risks and opportunities, focusing on areas with significant impact on our business activities.

The results of analysis related to the impact on our business of the associated risks and opportunities are as described on the following page.

- Referenced the IEA’s Announced Pledges Scenario (APS), the IPCC’s “RCP4.5,” the NGFS’ “Net Zero 2050,” etc.

- Referenced the IEA’s Stated Policies Scenario (STEPS), the IPCC’s “RCP8.5,” the NGFS’ “Current Policies,” etc.

Impact on strategies and plans

| Business area | Recognized impact | Incorporation into strategies and plans |

|---|---|---|

| Products and services | To realize a carbon-neutral society, various countries and regions are strengthening regulations for fuel economy/CO2 and zero-emission vehicles. These will affect our product development, production and procurement strategies. | In 2020, we formulated the Environmental Targets 2030, which set the target of achieving a 40% reduction in CO2 emissions from new vehicles (compared with FY2010 levels) and a target ratio of electrified vehicle sales of 50% by FY2030. In February 2023, we set a new target, raising our target ratio of electrified vehicle sales to 100% by FY2035. Meanwhile, in our mid-term business plan, “Challenge 2025” we set a target of introducing nine electrified vehicle models by FY2028. |

| Supply chain, value chain | In the automobile manufacturing and sales business, greenhouse gases such as CO2 are emitted not only during the manufacture of products, but throughout the entire value chain. As climate change advances, the worldwide risk of increasingly frequent and severe occurrences, such as typhoons and floods, is mounting. If our supply chain or value chain is affected by such events, our plants’ operations and sales could be affected. |

We revised our Environmental Targets 2030 in February 2023, adding the procurement target of “promoting CO2 reduction activities with major business partners,” and the logistics target of “promoting CO2 reduction activities in cooperation with transportation companies.” |

| Investment in R&D | We are promoting investment in R&D to address increasingly stringent and new regulations for fuel economy/CO2 and zero-emission vehicles in the countries and regions where we operate. These moves will affect our R&D costs for electrified vehicles and other products. | In our mid-term business plan, “Challenge 2025,” we are budgeting ¥70.0 billion in R&D expenses related to electrification in FY2025. We have also earmarked ¥55.0 billion in capital expenditures related to electrification. |

| Adaptation and mitigation measures | Our business could be affected by countries and regions introducing or expanding carbon taxes and emissions trading systems, as well as by rising energy costs. | In 2020, we formulated the Environmental Targets 2030 and set the goal of reducing CO2 emissions from our business activities “by 40% compared to FY2014.” In February 2023, we raised this figure to “a reduction of 50% compared to FY2018,” the SBT*6 target equivalent to a 1.5°C level. |

- Short for Science Based Targets, which are greenhouse gas emission reduction targets set by companies consistent with the Paris Agreement levels

Impact of Risks and Opportunities on the MITSUBISHI MOTORS Group’s Business Activities

| Scenario | Item | Risks/Opportunities | Impact on MITSUBISHI MOTORS’ business | Key countermeasures | |

|---|---|---|---|---|---|

| Less than 2°C | Strengthening of regulations for fuel economy/CO2 and zero-emission vehicles | Risks |

|

|

|

| Opportunities |

|

|

|

||

| Introduction and expansion of carbon pricing | Risks |

|

|

|

|

| Opportunities |

|

|

|||

| Growth | Increasing frequency and intensity of meteorological disasters (flooding, inundation) | Risks |

|

|

|

| Opportunities |

|

|

|

||

The MITSUBISHI MOTORS Group’s Response Measures Based on Risks and Opportunities

The Group will incorporate measures to address climate related risks and opportunities into our Environmental Plan Package and business strategies, which set forth the direction and goals of our environmental initiatives. In this way, we are promoting initiatives to reduce future risks, ensure sustainable business growth and enhance our resilience as a company.

On the product front, we will take our own plug-in hybrid electric vehicles (PHEV) and commercial electric vehicles in the Kei-car segment as a starting point, and leveraging the Allian’s technologies. We will develop electrified vehicles and promote fuel-efficient internal combustion vehicles, proactively introducing electrified vehicles that optimally meet customers’ needs, taking into consideration the energy situation and infrastructure development status in each country and region. Working toward carbon neutrality is one of the key challenges stated in “Challenge 2025,” our mid-term business plan. We will develop electrified vehicles and step up our efforts in the Alliance as we work toward the second phase of our plan to reinforce electrified vehicles (FY2026–FY2028). By FY2028, we plan to introduce nine electrified vehicle models. To date, we have introduced five: the “ASX PHEV/HEV models,” the “COLT HEV model,” the “XPANDER HEV model,” the “XPANDER CROSS HEV model,” and the “XFORCE HEV model.” Including models launched prior to February 2023̶ the “MINICAB EV/L100 EV,” “eK X EV,” “OUTLANDER PHEV model,” and “ECLIPSE CROSS PHEV model” -we offer a total of nine electrified vehicle models as of March 2025. In light of the global slowdown in the growth of battery EVs since 2024, we have adopted a policy of utilizing mainly OEM-supplied models from partners for battery EVs for the time being, and will concentrate our development efforts on PHEVs and HEVs, where we have a competitive advantage.

In our business activities, we are promoting energy minimization and the transition to renewable energy sources, and are working to reduce CO2 emissions.

Across the supply chain, we will collaborate with business partners, related companies and organizations, and governments and municipalities to reduce CO2 emissions at the production stage (through raw materials and parts) and in logistics (including products). We are also promoting renewable energy and charging infrastructure, utilize carbon-neutral fuel and promote V2X*7.

We believe the spread of electrified vehicles represents a chance to do new business in the form of reuse of used batteries, energy management, and data business using vehicle driving and battery data, and in collaboration with our partners and municipalities we will grow a mobility business that contributes toward the realization of a carbon-neutral society, which represents a unique opportunity for us as an automotive maker, into a fourth pillar of revenue after vehicle sales, financing (leasing), and after sales.

- V2X: A general term encompassing vehicle to home (V2H) and vehicle to grid (V2G), among others

Risk Management

a.Organization’s processes for identifying and assessing climate-related risks

The Group has established a cross-functional team under the Sustainability Committee to conduct scenario analysis based on the recommendations of the Task Force on Climaterelated Financial Disclosures (TCFD). We have identified and assessed climate-related risks and opportunities that could affect our business, considering their potential occurrence and impact levels. We have incorporated goals and action plans for addressing climate-related risks and opportunities that have a particularly significant impact, and are monitoring progress through the Sustainability Committee.

b.Organization’s processes for managing climate-related risks

The climate-related risks, opportunities, and corresponding measures identified by the Sustainability Committee have been assigned to responsible executives at the executive officer level. We have set KPI and are implementing a PDCA cycle. Additionally, reports on critical risks and opportunities requiring prompt action are provided to the Board of Directors, which decides on appropriate responses.

In FY2018, we identified material issues that we should address, involving various problems related to fields of the environment, society, and governance. We have positioned “responding to climate change and energy issues” as one of the most critical material issues, and we are stepping up our efforts in this regard across the Group.

c.How process of identifying, assessing, and managing climate-related risks are integrated into the organization’s overall risk management

Risks affecting our business are managed throughout the Group and include risks related to the effects of climate change. In addition, the Internal Control Committee manages operational hazard risk, based on the annual “Companywide Risk Survey.”

Metrics and Targets

a.Metrics used by the organization to assess

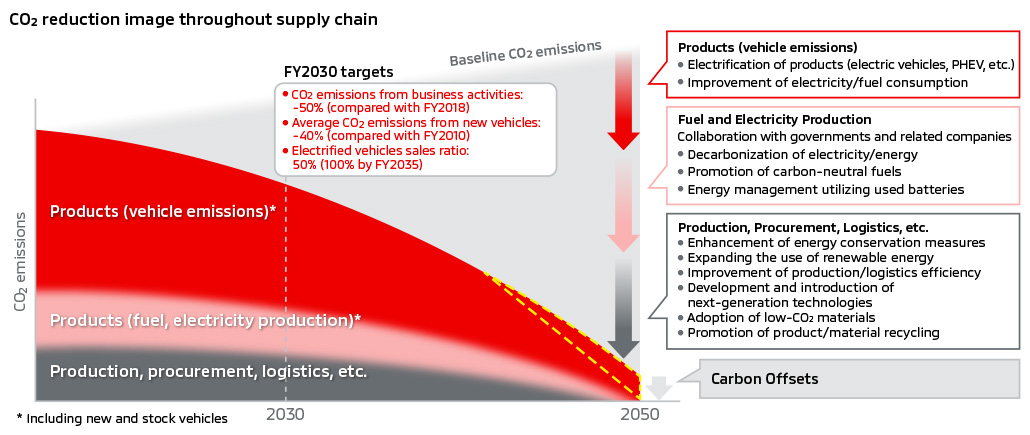

climate-related risks and opportunities in line with its strategy and risk management process The MITSUBISHI MOTORS Group formulated the Environmental Plan Package in 2020. Through electrified vehicles and the increased use of renewable energy, we aim to become carbon neutral by 2050 and contribute to the realization of a society that is resilient to climate change. We also formulated the “Environmental Targets 2030,” which clarifies specific initiatives to be achieved by 2030 in accordance with this vision. As major indices to be monitored and evaluated under “Action to Climate Change, we have established "CO2 emissions from business activities" for Scope 1 and 2*8, and "average CO2 emissions from new vehicles" and "ratio of electrified vehicle sales" for Scope 3*8 Category 11 (use of sold products) as key indicators for management and evaluation purposes.

In an effort to reinforce sustainable management, aimed at ensuring the Group’s sustainable growth, in FY2022 we added ESG-related items to an index used to determine the mediumto long-term performance-linked compensation for executive officers. In relation to the environment, we introduced “CO2 emissions from business activities” as an indicator to measure progress in addressing the escalating climate.

To move forward on efforts to reduce CO2 emissions, we introduced ICP (Internal Carbon Pricing:¥18,000 per ton of CO2) for domestic sites from FY2024, taking into account IEA and other international carbon prices. We use this as one of the factors for consideration when making decisions on capital investment.

- Scope 1 : A company’s direct emissions (such as from burning fuel)

Scope 2: Indirect emissions, resulting from electricity, heat or steam provided by another company

Scope 3: Scope 3: Indirect emissions other than Scope 1 and Scope 2 (Such as emissions due to the use of sold products)

b.Scope 1, 2 and 3 GHG emissions and related risks

MITSUBISHI MOTORS Group calculates CO2 emissions based on a GHG protocol. The table below shows the actual CO2 emissions for Scope 1, 2, and 3 in FY2018 (the base year for our CO2 emissions reduction target from business activities) and from FY2021 to FY2024.

To ensure our information is reliable and transparent, we have obtained independent third-party assurance for our Scope 1 and 2 emissions, as well as for Scope 3, Category 11 (use of sold products).

Scope 1, 2 and 3 Emission

| Unit | FY2018 | FY2021 | FY2022 | FY2023 | FY2024 | |

|---|---|---|---|---|---|---|

| Scope1 | x103 t-CO2 | 119 | 92 | 95 | 90 | 85 |

| Scope2 | x103 t-CO2 | 469 | 319 | 271 | 264 | 243 |

| Scope3 | x103 t-CO2 eq | 42,580 | 28,294 | 28,710 | 31,743 | 29,713 |

| Total | x103 t-CO2 eq | 43,168 | 28,705 | 29,076 | 32,097 | 30,041 |

c.Targets used by the organization to manage climate-related risks and opportunities and performance against targets

Major FY2030 Targets and Progress

| Indicators | FY2030 Target |

FY2035 Target |

FY2023 Result |

|---|---|---|---|

| Average CO2 emissions from new vehicles (Tank to Wheel) |

–40% (Compared to FY2010) |

- | –19% (Compared to FY2010) |

| Ratio of electrified vehicles sales | 50% | 100% | 16% |

| CO2 emissions from business activities (Total Scope1 and 2) |

–50%*9 (Compared to FY2018) |

- | -40% (Compared to FY2018) |

- FY2018 Scope 1 and Scope 2 emissions of 588 thousand t-CO2 include emissions of 43 thousand t-CO2 from certain equity-method associates.

In March 2023, we reviewed our targets in line with the latest perspectives on selecting companies subject to environmental management. After subtracting emissions from these equity-method associates, we revised our base figure to 545 thousand t-CO2.